Streamline Your Loan Management with Ease

Unlock the power of efficient loan management with our cutting-edge software solution, designed to revolutionize the way you handle your lending operations.

Solutions

Business Productivity Platform for DSA

Unlocking Your Potential, Unleashing Your Success

PARAM is a cloud-based loan management software tailored to the unique needs of Direct Selling Agents (DSAs) in the Indian banking industry. With PARAM, you can streamline customer lead management, document processing, loan tracking, and post-loan services, all in one platform. Whether you're handling customer acquisition or managing post-disbursement services, PARAM simplifies the complexities of the loan lifecycle.

Product Overview

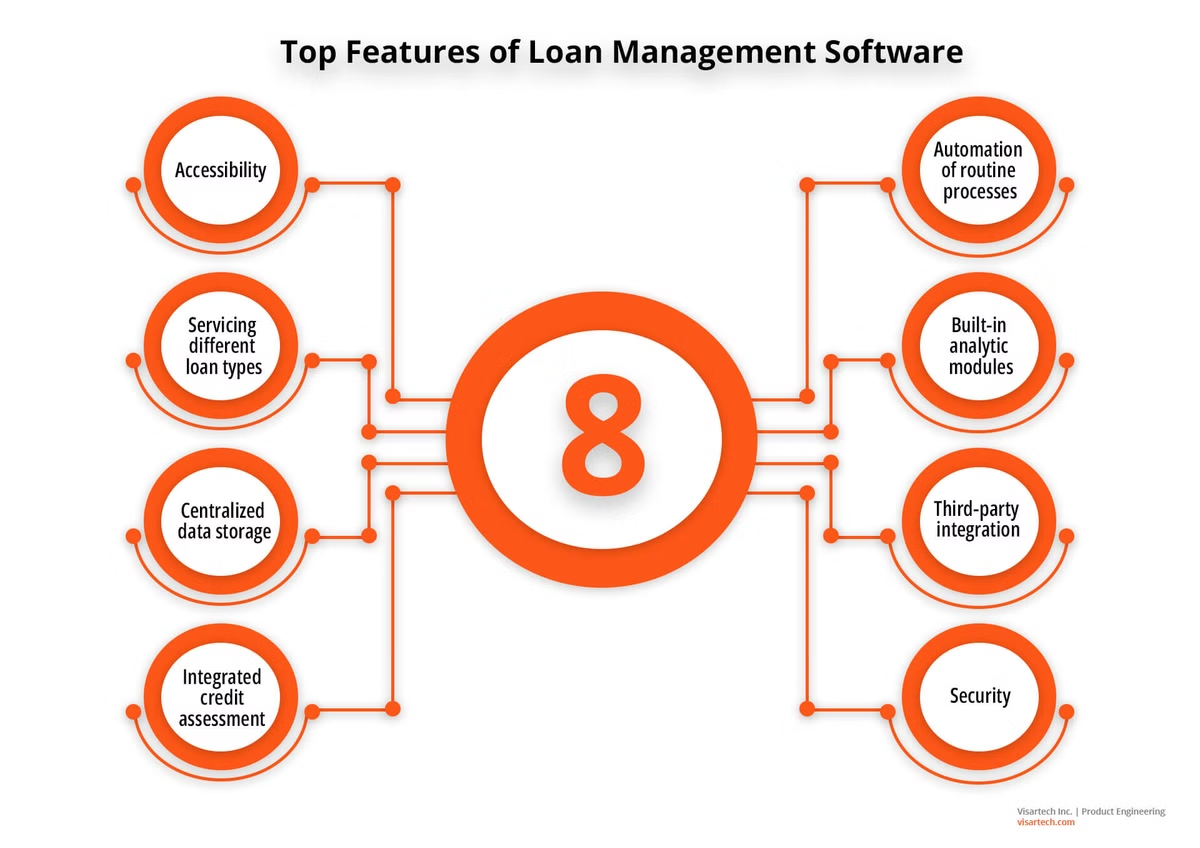

Comprehensive Loan Management

Our software offers a centralized platform to manage the entire loan lifecycle, from customer onboarding to disbursement, repayment, and analytics. Stay on top of your lending operations with ease.

Intelligent Decision Making

Leverage our advanced algorithms and data-driven insights to make informed decisions about loan eligibility, risk assessment, and optimal loan repayment plans. Streamline your lending processes for maximum efficiency.

Seamless Integrations

Seamlessly integrate our loan management software with your existing systems and workflows, ensuring a smooth and cohesive user experience. Unlock the power of data-driven collaboration across your organization.

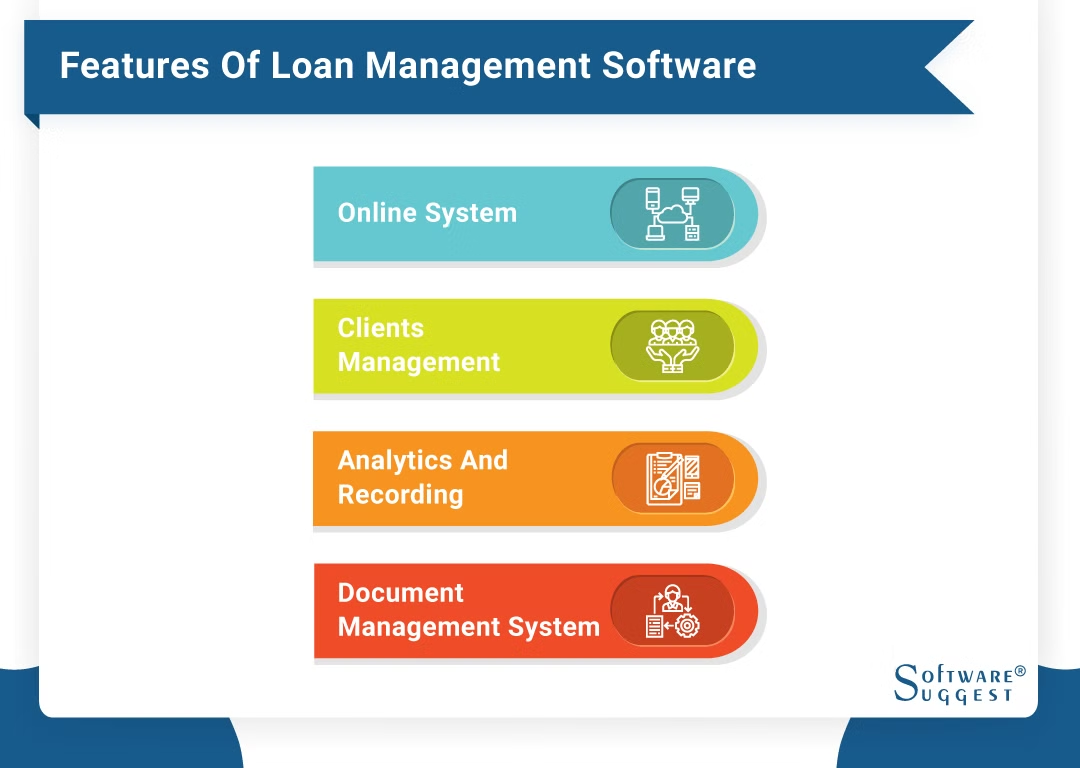

Key Features

Customer Relationship Management

Maintain a comprehensive database of your customers, including their personal information, credit history, and loan details. Personalize your interactions and provide exceptional customer service.

Loan Process Automation

Automate key lending processes, such as application intake, eligibility assessment, document management, and disbursement, to streamline your operations and reduce manual errors.

Robust Reporting and Analytics

Generate in-depth reports and analyze crucial lending metrics, enabling you to make data-driven decisions, identify trends, and optimize your loan portfolio for maximum profitability.

Secure and Compliant

Ensure the confidentiality and security of your loan data with advanced encryption and access controls. Stay compliant with industry regulations and guidelines to mitigate risk.

Usage Scenario

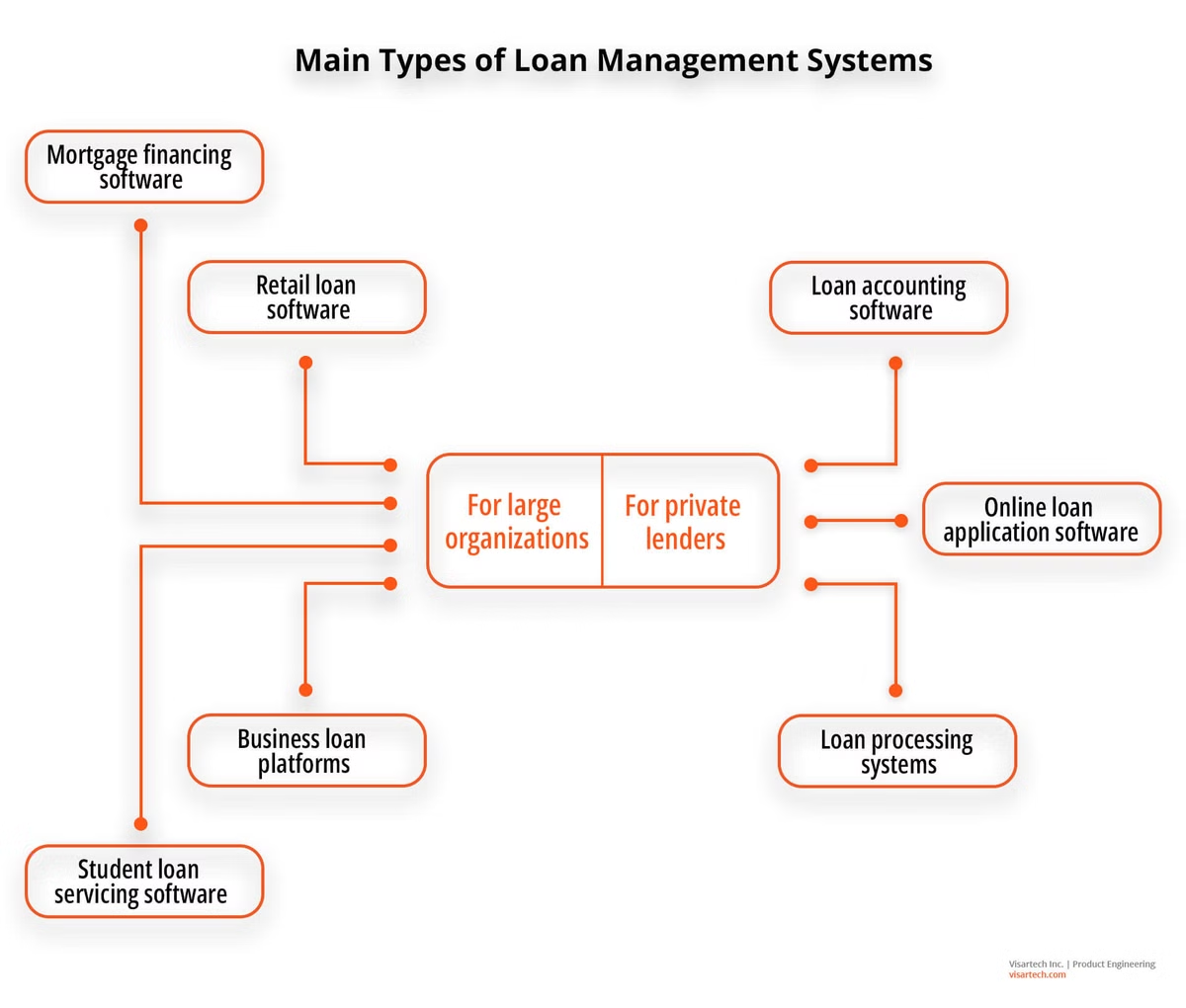

Small Business Lending

Efficiently manage loan applications, underwriting, and disbursement for small business clients. Tailor your lending strategies to support the growth and success of local enterprises.

Mortgage Loan Processing

Streamline the entire mortgage loan lifecycle, from pre-approval to closing, ensuring a seamless experience for your customers and reducing processing times.

Consumer Lending

Provide personal loans, auto loans, and other consumer financing options with ease. Leverage our software to assess creditworthiness, automate approvals, and manage repayments.

Implementation Guidelines

1 Discovery

Our team will work closely with you to understand your unique lending requirements, existing processes, and pain points. This collaborative discovery phase will help us tailor the solution to your specific needs.

2 Deployment

AWe'll guide you through a seamless deployment process, ensuring a smooth transition to our loan management software. Our expert consultants will handle the configuration, integration, and user training.

3 Ongoing Support

Even after the initial implementation, our dedicated support team will be available to assist you with any questions, troubleshoot issues, and provide regular software updates to keep your system optimized.

Product Roadmap

1 Mobile Application

Empower your customers and loan officers with a user-friendly mobile app, enabling them to access loan information, submit applications, and manage payments on-the-go.

2 Artificial Intelligence

Leverage advanced AI and machine learning algorithms to automate credit assessments, predict customer behavior, and identify cross-sell opportunities, further enhancing your lending operations.

3 Blockchain Integration

Explore the integration of blockchain technology to improve data security, streamline inter-institutional transactions, and provide a tamper-proof audit trail for your loan records.